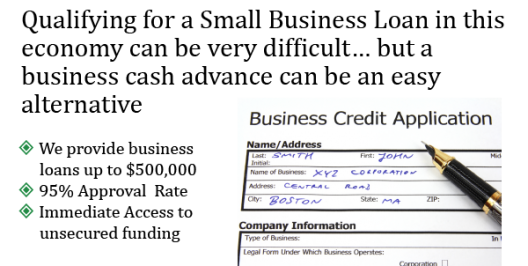

How It Works

- 4 most recent months of Credit Card Processing statements

- 4 most recent months of bank statements

- Completed Application

The Offer

The written business loan offer will contain the amount your business will have easy access to. You have no restriction on how you can use the money. Buy equipment, pay down debt, hire employees or use it for whatever your business needs.

No Compund Interest

A small pre-determined percentage is taken out of your daily credit card sales volume at the time you settle out your machine for the day. You dont have to worry about late payments, penalties or compunded interest. Your payout percentage does not increase if you need to take a bit more time to pay off the advance.

No Worries, We Will Work With Your Schedule

If your business is closed for the day or week or you are on vacation and you did not settle your credit card machine, there is no payment because you did not batch the machine and your balance does not move up. There are no late fees, penalties, minimum monthly payments or checks to write.

Once the loan is paid off, if you still require access to more cash, payments stop and you can still have the pre-approval for another business loan.